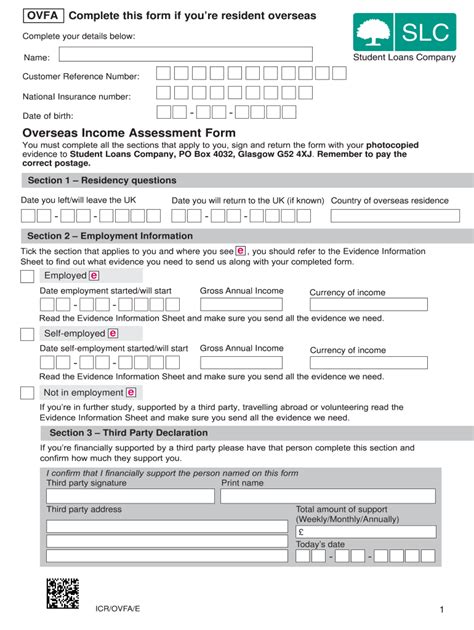

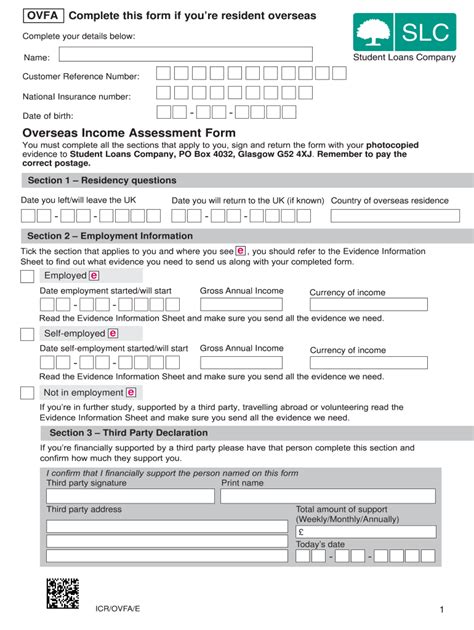

slc overseas income assessment form|hmrc form sa106 : 2024-10-08 1. Section 4 - Your UK Bank/Building Society Account Details. The easiest way to make repayments whilst overseas is to set up a monthly Direct Debit. Simply complete the . Bestel een iPhone 8 Plus hoesje met shockproof kwaliteiten bij hoesjesdirect.nl en geniet van gratis verzending, een retourtermijn van maar liefst 60 dagen en kosteloze ruilservice indien .

0 · slc repayment form

1 · slc overseas thresholds

2 · repaying student loan from overseas

3 · plan 2 threshold overseas

4 · overseas earnings threshold 2022 23

5 · overseas earnings threshold 2022

6 · hmrc form sa106

7 · hmrc foreign income pages

8 · More

Shop al je adidas producten online in de categorie: Classics. Met meer dan 5000 .

slc overseas income assessment form*******HM Revenue and Customs (HMRC) will work out how much you pay from your tax return. You pay at the same time as you pay your tax. See more

1. Section 4 - Your UK Bank/Building Society Account Details. The easiest way to make repayments whilst overseas is to set up a monthly Direct Debit. Simply complete the . An Overseas Income Assessment Form gives details of your circumstances and income. This shows the Student Loans Company how you support .

If you are planning to live outside the UK for more than three months, you must update the Student Loans Company before you leave. You will be asked to complete an ‘Overseas . Overseas income assessment. You can tell the SLC about your living situation and how much you're earning online on .

hmrc form sa106 2. Fill out the Overseas Income Assessment Form. The SLC will ask you to complete an Overseas Income Assessment Form, providing details of your .

Before you leave the UK, you should complete an Overseas Income Assessment Form so SLC can calculate if you need to repay. They’ll send you a repayment schedule showing .

We use the “overseas repayment threshold for Plan 1” table to calculate your repayment amount, by using the following steps: We’ll convert your gross annual .

If you’re planning on crossing the border for more than three months, it’s essential you inform the SLC and complete an overseas income assessment form .

If you’re planning on crossing the border for more than three months, it’s essential you inform the SLC and complete an overseas income assessment form . If you received a UK student loan and you leave the UK for more than three months after finishing your course, you must inform the Student Loans Company (SLC). .slc overseas income assessment form The SLC uses these repayment thresholds over a 12-month period from when you are working abroad, so this may differ from the UK tax year (which runs from 6 April to 5 April). If you do not contact the SLC to complete an overseas income assessment, then repayment arrears may build up on your loan account. If this happens then you should .

Future years. If you’re awarded a current year income assessment, we’ll use your fnalised 2021-22 household income to work out how much the student can get if they apply for funding based on household income for their next academic year(s). If your income falls by a further 15% or more, you can apply for another current year income assessment.Estimated income from self-assessment. 6.1. Self-employment Expected taxable profit from businesses. Person 1. Person 2. Expected taxable profit from partnerships. 6.2. Foreign income. Include the foreign currency and amount you expect to declare to HM Revenue and Customs. Name of foreign currency, for example euro, dollar, etc. .

Get the Overseas Income Assessment Form - Student Loan completed. Download your adjusted document, export it to the cloud, print it from the editor, or share it with other participants using a Shareable link or as an email attachment. . SLC will ask for details of your income and will work out how much you should repay each month. Related .Begin by obtaining the overseas income assessment form from the appropriate authority, such as the tax department or government agency responsible for overseas income reporting. 02 Carefully read through the instructions provided with the form to ensure that you understand the requirements and any supporting documentation that may be needed.

slc overseas income assessment form hmrc form sa106If your household income has dropped by 15% since tax year 2020-21 you can apply for a ‘Current Year Income Assessment’. This means we would use your expected income for tax year 2022-23 instead of your actual income from tax year 2020-21 when calculating the student’s entitlement. However, there must be at least a 15% drop in the overall .

However, if you'll be away for less than 3 months, you don’t need to notify the SLC, because you’ll still be considered a UK taxpayer. 2. Fill out the Overseas Income Assessment Form. The SLC will ask you to complete an Overseas Income Assessment Form, providing details of your employment status and income. You must be detailed .

leave the UK for more than 3 months (for example, you go travelling or move overseas) return to the UK after more than 3 months away. get a letter or email from the Student Loans Company ( SLC .

How to complete this form. Provide your most up to date estimated figures for each income type for the full tax year. For any income type you don’t have, leave the box blank. When giving us your updated figures, think about if you’ve: worked overtime or extra hours. received maternity pay. done any casual work, shift work or contract work.We would like to show you a description here but the site won’t allow us.

Execute Overseas Assessment Form Slc in just a couple of moments by using the recommendations below: Find the template you want from our library of legal forms. Select the Get form button to open the document and begin editing. Fill out all the necessary boxes (they will be marked in yellow). The Signature Wizard will enable you to put your e .

Estimated income from self-assessment. 6.1. Self-employment £Expected taxable profit from businesses. Person 1 £ Person 2 £Expected taxable profit from partnerships £ 6.2. Foreign income. Include the foreign currency and amount you expect to declare to HM Revenue and Customs. Name of foreign currency, for example euro, dollar, etc. .

You’re on Plan 2, living in Spain and have an income of €33,000 a year. Your salary is converted to GBP using the exchange rate for Spain which is 0.869943: €33,000 x 0.869943 = £28,708.11 .We would like to show you a description here but the site won’t allow us.Execute Overseas Assessment Form Slc in just a couple of moments by using the recommendations below: Find the template you want from our library of legal forms. Select the Get form button to open the document and begin editing. Fill out all the necessary boxes (they will be marked in yellow). The Signature Wizard will enable you to put your e .

Estimated income from self-assessment. 6.1. Self-employment £Expected taxable profit from businesses. Person 1 £ Person 2 £Expected taxable profit from partnerships £ 6.2. Foreign income. Include the foreign currency and amount you expect to declare to HM Revenue and Customs. Name of foreign currency, for example euro, dollar, etc. . You’re on Plan 2, living in Spain and have an income of €33,000 a year. Your salary is converted to GBP using the exchange rate for Spain which is 0.869943: €33,000 x 0.869943 = £28,708.11 .Future years. If you’re awarded a current year income assessment, we’ll use your finalised 2020-21 household income to work out how much the student can get if they apply for funding based on household income for their next academic year(s). If your income falls by a further 15% or more, you can apply for another current year income assessment. As I received an Overseas Income Assessment Form in December but I was still unemployed, I decided to wait with completing and returning the form back until I get employment. Currently I'm doing a 6 months internship programme which is paid and the salary is over my monthly earning threshold (if this figure 6,320 is the annual earning .Select the CocoDoc PDF option, and allow your Google account to integrate into CocoDoc in the popup windows. Choose the PDF Editor option to move forward with next step. Click the tool in the top toolbar to edit your Overseas Income Assessment on the field to be filled, like signing and adding text. Click the Download button to keep the updated .

Estimated income from self-assessment. 6.1. Self-employment £Expected taxable profit from businesses. Person 1 £ Person 2 £Expected taxable profit from partnerships £ 6.2. Foreign income. Include the foreign currency and amount you expect to declare to HM Revenue and Customs. Name of foreign currency, for example euro, dollar, etc. .Estimated income from self-assessment. 6.1. Self-employment Expected taxable profit from businesses. Person 1. Person 2. Expected taxable profit from partnerships. 6.2. Foreign income. Include the foreign currency and amount you expect to declare to HM Revenue and Customs. Name of foreign currency, for example euro, dollar, etc. .

Estimated income from self-assessment. 6.1. Self-employment £Expected taxable profit from businesses. Person 1 £ Person 2 £Expected taxable profit from partnerships £ 6.2. Foreign income. Include the foreign currency and amount you expect to declare to HM Revenue and Customs. Name of foreign currency, for example euro, dollar, etc. .OVFA Complete this form if you’re resident overseas Complete your details below: Name: Customer Reference Number: NationaI Insurance number: Date of birth: Overseas Income Assessment Form You must complete all the sections that apply to you, sign and return the form with your photocopied evidence to Student Loans Company, PO Box 4032, .Estimated income from self-assessment. 6.1. Self-employment £Expected taxable profit from businesses. Person 1 £ Person 2 £Expected taxable profit from partnerships £ 6.2. Foreign income. Include the foreign currency and amount you expect to declare to HM Revenue and Customs. Name of foreign currency, for example euro, dollar, etc. .

Shop jouw Adidas Firebird Maat 23 bij Zalando | Makkelijk & .

slc overseas income assessment form|hmrc form sa106